Why This Still Matters Today

Shipping remains one of the top three operating costs for e-commerce businesses, often accounting for 10–15% of total expenses. With FedEx and UPS announcing annual rate hikes averaging 5.9–6.5% and surcharges evolving constantly, the impact on margins is sharper than ever. For retailers navigating tariffs, peak-season surcharges, and international complexity in 2025, a shipping invoice audit is no longer optional it’s the only way to ensure you’re not leaving money on the table.

Yet, most businesses still rely on manual processes or don’t audit at all, losing out on 6–20% in recoverable shipping costs.

Why Shipping Invoices Are a Gold Mine of Errors

Carriers process millions of packages daily. Mistakes whether small or systemic are inevitable. Without auditing, you’re paying for errors that should have been credited back.

The most common billing errors every retailer should watch for include:

- DIM weight miscalculations — packages billed at inflated dimensional weights instead of actual weight.

- Incorrect surcharges — residential, fuel, address correction, or oversized fees wrongly applied.

- Late deliveries — carriers missing guaranteed service times but still charging in full.

- Duplicate billings — the same package invoiced more than once.

- Manifested but not shipped — labels billed despite shipments never moving.

- Erroneous address corrections — fees charged when the original address was valid.

Each of these errors may look insignificant on its own, but across thousands of shipments they accumulate into hundreds of thousands of dollars lost annually.

The Carrier Agreement Fine Print

Auditing only delivers value if it aligns with your carrier contracts. FedEx, UPS, DHL, and regional carriers include service guarantees and refund policies in their agreements. Understanding these clauses is crucial.

Service guarantees, for instance, often promise overnight deliveries by 10:30 a.m. and any delay is grounds for a refund. But many retailers unknowingly sign away such guarantees when they agree to new terms.

Accessorial fees like fuel, residential, or oversized surcharges also vary between carriers and are frequently misapplied. These fine-print details shape your recovery potential.

The Pitfalls of Manual Audits

On paper, manual auditing sounds straightforward: match invoices with shipment data, flag inconsistencies, and file claims. In practice, it’s overwhelming and highly inefficient.

Invoices often arrive in different formats, making reconciliation error-prone. The sheer data volume is daunting a mid-size retailer shipping 10,000 parcels a month faces more than 120,000 individual data points to audit. Add to that the frustration of filing disputes manually, which often results in delays and outright denials from carriers, and it becomes clear why most businesses capture less than 20% of recoverable credits when relying on manual processes.

International shipments compound the problem. Duties, taxes, brokerage fees, and fluctuating exchange rates all introduce additional opportunities for error, which manual teams struggle to catch.

Why 2025 Makes Audits Even More Critical

The current year brings unique headwinds that make invoice audits indispensable. Tariffs and geopolitical shifts have created unpredictable surcharge patterns. Peak-season shipping strains guarantee reliability, generating even more late deliveries and refund opportunities. Meanwhile, cross-border sales are growing, bringing with them higher error rates on customs and duties.

On top of that, carriers are experimenting with AI-driven dynamic pricing models, introducing constantly shifting surcharges. A manual audit team simply cannot keep pace. Automated audits are no longer a nice-to-have they’re the only way to keep your shipping spend in check.

How to Implement an Automated Audit

Turning invoice audits into a consistent profit lever requires a structured approach. Retailers who succeed tend to follow a clear path:

- Baseline your costs by reviewing 3–6 months of historical invoices to spot leakage trends.

- Ensure seamless data access by integrating carriers, ERPs, and shipping platforms.

- Audit daily, not monthly since refund eligibility is time-sensitive.

- Track refund performance to monitor weekly and monthly recovery rates.

- Go beyond refunds by using audit insights to renegotiate carrier contracts and refine your shipping mix.

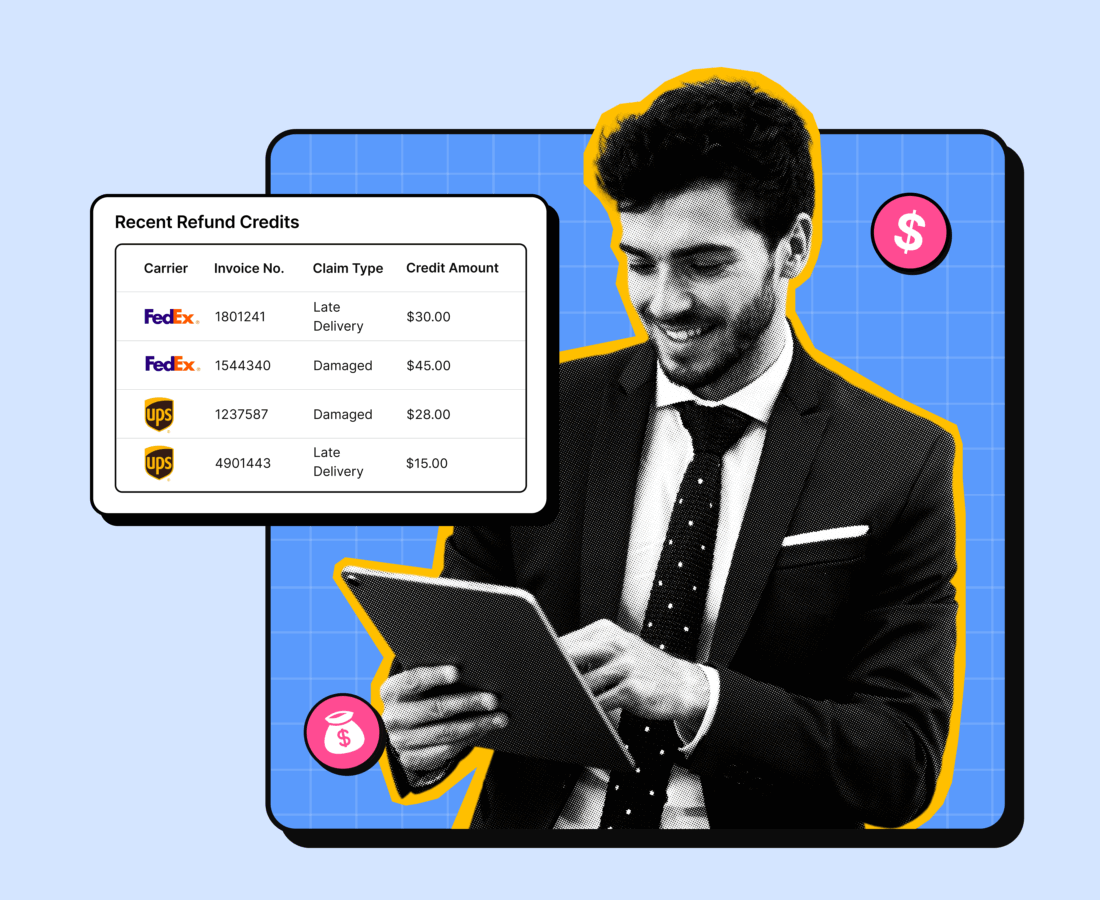

Why LateShipment.com Is the Only Platform You Need

LateShipment.com’s Automated Shipping Invoice Audit detects delivery exceptions before customers complain, automates claims for lost or damaged packages, and integrates audit insights into tracking and returns modules for complete visibility. It works globally across FedEx, UPS, DHL, USPS, and over 1,200 carriers. And because it is seamlessly connected with other solutions like branded tracking and intelligent returns, it creates a truly unified post-purchase ecosystem.

Customers recover up to 20% of shipping costs they were unknowingly paying carriers all with zero manual effort.

Stop Leaving Money on the Table

In today’s margin-tight environment, every overcharge or denied refund chips away at profitability. Manual audits cannot keep pace with the scale, complexity, and international reach of modern shipping operations.

With automated audits, you not only recover hidden dollars but also gain the operational clarity to manage your logistics spend with confidence.