Introduction

In the world of last-mile deliveries in the US, 2019 is a landmark year; For the first time in a very very long time, the duopoly of FedEx and UPS in the US market is being seriously challenged by a competitor: Amazon.

For the first time in a very very long time, the duopoly of FedEx and UPS in the US market is being seriously challenged by a competitor.

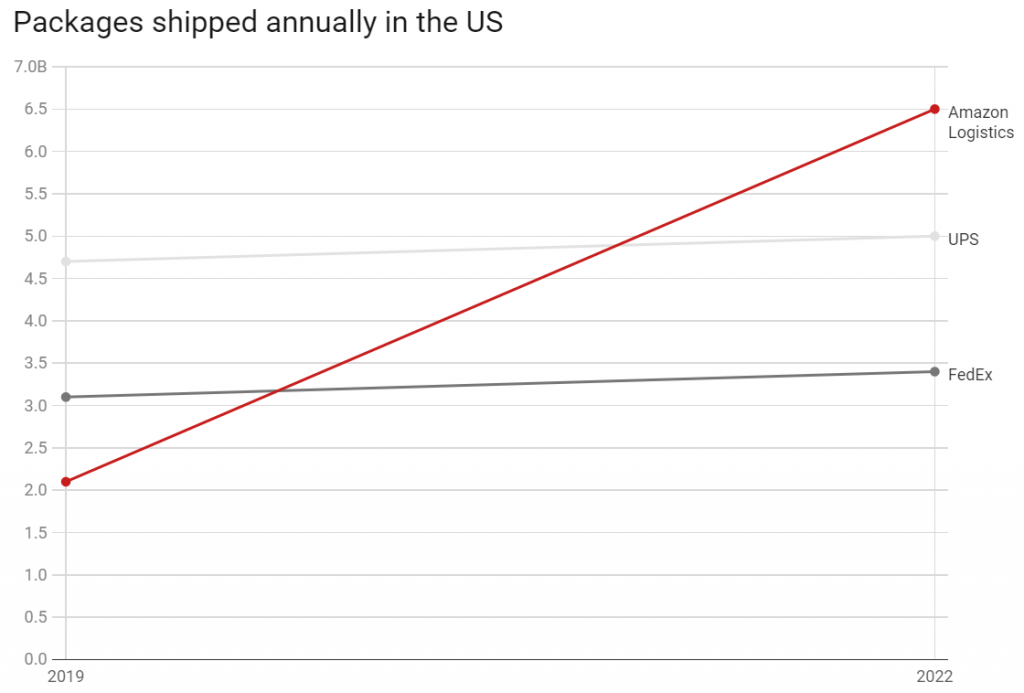

In 2019, Amazon Logistics is set to finish the year handling around 2.5 Billion shipments. This is 2x what it handled in 2018 and getting eerily close to the 3 Billion mark of FedEx and the 4.7 Billion mark of UPS. This is no mean feat even for a company like Amazon and represents more than a decade of effort behind the scenes to own the complete shopping experience of a customer from procurement to unboxing.

From the perspective of a tech company that operates in the shipping and logistics space and which is an active advocate for transparency and choice in this space, this is exciting news that can potentially disrupt this space and bring a host of positive changes to both shippers and end customers who receive those shipments.

Here we attempt to take a closer look at the impact that Amazon Logistics has had on Holiday Season 2019 and what the future potentially holds for them in the small parcel shipping carrier space currently dominated by FedEx and UPS.

Why is Amazon Logistics a big deal?

While last-mile deliveries may seem like just another component in the long list of things Amazon does, the reality is far from it. This happens to be an exceptionally important component of their “customer obsession” mission and helps them build a critical advantage over other online merchants.

When you look closer, every online merchant, including Amazon, traditionally relied on a shipping carrier like FedEx or UPS for their last-mile deliveries. This meant that a merchant’s shipping speed, costs, and delivery experience were restricted to what was offered by these shipping carriers. In a country like the US, with a near duopoly between two carriers, this often meant very little flexibility or control for merchants over their shipping.

In the US, the near duopoly between two carriers has meant little flexibility or control for merchants over their shipping.

This limitation was something that Amazon has always resented as it left the final portion of a customer’s shopping experience in the hands of a shipping carrier, which often had different objectives compared to Amazon. For instance, providing a tighter delivery window, offering flexible redelivery options, ensuring that a high-value shipment or customer is given special treatment, providing in-home deliveries to combat package theft, etc. may be of high importance to Amazon, being the seller a customer has a direct relationship with. But, a shipping carrier, which is simply paid for transporting a shipment from A to B, often has very different objectives compared to the seller and customer. This mismatch has always been a pain point for customer-obsessed businesses like Amazon.

Taking direct control of this final piece of the shopping experience will enable Amazon to have direct control over a customer’s order right from the moment a customer lands on their website to the moment the customer unboxes the product, enabling Amazon to have a remarkable customer experience advantage over the competition.

Just imagine being able to order something in the morning, pick a 30 min delivery window late next evening, rescheduling that effortlessly if needed or even giving the delivery person permission to step in and leave the product in your living room vs picking another merchant who will be delivering through FedEx or UPS throwing the delivery across your fence 3 days later. That’s the magnitude of difference in experience Amazon Logistics can bring to the table for Amazon.

How did Amazon Logistics succeed where others could not?

The biggest limitation that has prevented serious new competition from emerging in the shipping carrier space to challenge FedEx and UPS has been the very high infrastructure investment required to operate at a national level as a shipping carrier. The shipping volumes required to justify such an investment have always been very high and it remains exceptionally risky for a new entrant to bet on achieving these massive volumes to be successful.

Amazon, on the other hand, managed to circumvent this challenge by independently growing to be a shipper large enough to easily justify such investments, thus allowing it not only to become an independent carrier that satisfies their own shipping needs but also offer shipping services to other merchants who may or may not be selling on Amazon; in other words, reduce its own dependency on FedEx and UPS and offer a serious alternative for other merchants using FedEx and UPS.

How is Amazon Logistics different from shipping carriers?

Let us imagine a customer in California ordering a product from a merchant in New York and. on the same day, a customer in New York ordering the same product from a store in California. When these merchants rely on FedEx or UPS, this situation will result in two cross country shipments of 3+ days, each with a higher probability of delays compared to shipments that travel a lesser distance.

With Amazon through, since they are also the merchant and have control over inventory and shipping locations, the order from California would be fulfilled probably the same day from a warehouse in California and the order in New York similarly so from a warehouse in New York.

This direct control over inventory and shipping locations offers Amazon the ability to optimize transportation costs, performance, and efficiency far better than a traditional shipping carrier like FedEx or UPS. When Amazon Logistics makes a move to corner the non-Amazon shipping market down the line, this considerable expertise in managing fulfillment as a whole is likely to see them offering comprehensive and innovative fulfillment solutions that go beyond just the shipping services offered by traditional carriers.

How did Amazon Logistics perform this year?

This is the first year Amazon Logistics is operating at a scale comparable to FedEx and UPS and we project their performance numbers to match up to those of FedEx and UPS with Holiday performance being right around the 8% delay mark. For a first attempt, this is commendable indeed.

With the inventory and fulfillment location advantages that Amazon enjoys, we expect performance numbers to get far better than those of FedEx and UPS in the next 1–3 years, especially because Amazon is relentless in trying to improve performance and expand its footprint in this space.

Image Courtesy: www.vox.com/recode

What does the future hold for Amazon Logistics?

For the reasons stated above, Amazon Logistics is a very serious effort for Amazon; something that Amazon has put a tremendous amount of background work into over more than a decade and something we expect Amazon to be relentless in trying to perfect.

We expect Amazon Logistics to have a massive impact on the shipping space, comparable to the significant impact AWS had on cloud computing. We expect it to grow into a huge, invisible backbone that powers e-commerce across the US.

We expect Amazon to focus on perfecting its own deliveries and taking on the deliveries of merchants using FBA. 2019 saw them handling 46% of such deliveries and 2020 is likely to see that expand to around the 70% mark. At this point, we expect to see Amazon open up Amazon Logistics on a large scale, as a serious alternative to FedEx and UPS, for non-Amazon sellers and shipments. This move will likely double it’s 2.5 Billion parcel volume by 2021 and eat into the 82% share of FedEx, UPS, and USPS in the small parcel space, giving Amazon about 40% of that market by 2023.

Amazon has far more interest in focussing on delivery speed and experience than traditional shipping carriers as most shipments are sent to its own customers. This is likely to make Amazon obsessively focus on on-time deliveries and more flexible and customer-friendly delivery options such as in-home deliveries, batch deliveries, and night deliveries and tighter delivery windows.

We estimate Amazon to achieve >98% on-time deliveries all through the year, including the holiday season, with a significant rise in more customer-friendly delivery offerings by 2021.

Final Word

Irrespective of whether we take the perspective of a customer or of a merchant, Amazon’s much-anticipated entry into the last mile space is exciting news. The massive competition that Amazon brings is likely to revitalize tech penetration in this space and bring about a succession of rapid changes that are likely to enable merchants and customers more of a say in how packages are shipped between them.

_________________________________________

This is an article by Sriram Sridhar, CEO at LateShipment.com.