As an e-commerce business owner, you’re no stranger to the intricate world of shipping and logistics. You work tirelessly to ensure that your products are carefully packaged, promptly shipped, and arrive safely in the hands of your customers.

But in the unpredictable realm of shipping, accidents and mishaps can happen anytime and to anyone, potentially hurting your relationships with your customers. That’s where shipping insurance steps in to save the day.

If you’re an e-commerce merchant worried about the probability of such issues and their impact, you can try your hand at getting shipping insurance to help you cover such costs.

A Look into Shipping Insurance

Imagine making a successful sale to one of your high-value customers and getting a notification from them, a few days later, that the package has been damaged.

All of you can think about how you need to recover from this. Even if you reimburse the entire cost to ensure your customer won’t be disappointed, you still have to be worried about the financial loss that you’re set to face.

But if you had shipping insurance, you wouldn’t have to worry.

Shipping insurance would reimburse you for the value of the lost package, so you could replace it for your customer and still make a profit.

Shipping insurance is like a safety net for e-commerce businesses. It protects your shipments from financial losses in the event of lost, damaged, stolen packages, or even natural disasters.

While that’s to scratch the surface, while talking in-depth, package insurance is a much-needed aspect of shippers. Here’s how.

The Importance of Shipping Insurance

E-commerce businesses should insure their packages for several crucial reasons:

1. It offers protection against loss and damage

We’ll start with the most basic reason — insurance stands to protect your shipments against common errors such as loss and damage.

A well known fact is that shipping is a complex process, and packages can be lost or damaged during transit. Stats say that 11-15% of packages get lost or damaged in the U.S. in a year. Your customers’ packages can end up being one of them too.

With proper protection in the form of insurance, losses and damages will only be considered as isolated shipping incidents instead of having the potential to cause any actual harm to your business.

2. It is easy to get yet an invaluable asset for your business

Since insurance is added per package, it is actually easy as paying an additional fee to your shipping costs and can be done with minimal to low paperwork. Despite being easy to get, shipping insurance must not be considered trivial, as it has multiple pros for your business.

With insurance, your business has a backup both against damages as well as losses they bring. On the customer front, compensating them when faced with issues helps in restoring both lost customer satisfaction and brand reputation.

3. It offers steady peace of mind

In your business’ daily operations, the last thing you want to worry about is the potential for significant loss due to damage or shortage.

Investing in shipping insurance based on your thorough understanding of carrier and third-party options as well as the importance of documentation will help you get the most out of your insurance plan, giving you peace of mind in your shipping procedures.

4. It offers a sense of financial security

The cost of a lost or damaged shipment can be really high, especially for high-value items or fragile products.

$500K is the estimated loss for e-commerce businesses from lost and damaged packages in a year. (Source: National Retail Federation)

Worry not! Shipping insurance provides financial security by covering the declared value of the shipment, preventing your business from bearing the full cost.

With shipping insurance providing financial protection, you can practically ensure that your business doesn’t suffer financial losses when such incidents occur.

5. It mitigates unforeseen risks

Now getting to the part for what shipping insurance actually stands for.

No matter how equipped your businesses are, there are always unforeseen events such as theft, natural disasters, or accidents in the post-purchase phase that have the potential to hurt your business.

By having insured your packages, you can ensure that your business doesn’t suffer significant financial losses due to circumstances beyond your control. This way there is complete preparation — even against threats you don’t see coming.

In short, with guaranteed protection from financial losses and reputational damage, shipping insurance is an investment that is not to be missed out on for e-commerce businesses.

Now that you have better clarity on what shipping insurance brings to the table, let’s move on to different insurance options for you to choose from.

What Are the Different Types of Shipping Insurance

If you’re planning to get started with shipping insurance, there are two primary options for you:

- Carrier Insurance: Many shipping carriers, such as FedEx, UPS, and USPS, offer insurance as an optional add-on service. This type of insurance is convenient because it can be purchased directly through the carrier when shipping a package. However, carrier insurance may have limitations in terms of coverage and reimbursement.

- Third-Party Insurance: E-commerce businesses can also opt for third-party insurance providers specializing in shipping coverage. These providers offer more flexibility and often provide broader coverage options than carrier-provided insurance. They may also be cost-effective for businesses with frequent shipments.

How to Get the Most out of Shipping Insurance

1. Understand what’s usually covered in parcel insurance

Beyond general guidelines from insurance providers, it is important to understand that there are some exceptions to what is and isn’t covered by them.

For instance, major carriers such UPS, FedEx, and USPS do not insure precious stones or coins. Also, the maximum declared value for a lot of items including artworks, antiques, highly fragile items, dangerous goods, etc. are lesser compared to traditional items with most carriers.

Thus, in your effort to understand what is covered by the major carriers, it’ll be helpful to review similar freight exclusions that may limit your return on investing in shipping insurance.

2. Strengthen claims with documentation

Insurance claims are much easier to fill out with documentation. Properly documenting loss or damage will make for a faster, smoother, and easier claims process.

To clarify and strengthen your claim, take notes and photographs of the freight to prove that it was damaged or otherwise compromised in transport. Most importantly, holding onto documents like the original bill of lading, a paid freight invoice, and a packing slip will be helpful in allowing you to identify and file claims.

When there is a concealed damage or shortage that’s discovered after the proof of delivery is signed, it can often be more difficult to get your full claim back. Thus, it’s essential to thoroughly examine incoming shipments for quality and document anything that may seem out of order before signing for the delivery.

Documentation is critical because it’s the way your company can prove loss, damage, or shortages in the insurance process. Leverage it strategically for the most success with claims.

3. Explore third-party options

Like we mentioned earlier, large carriers aren’t the only organizations that offer shipping insurance to companies. There are also plenty of third-party options that provide businesses with their own benefits.

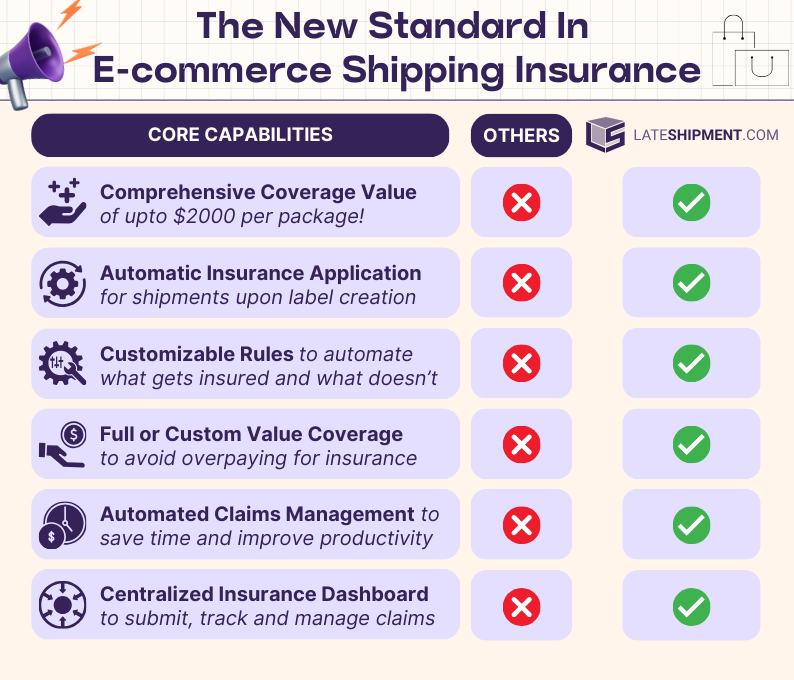

A third-party shipping insurance provider like LateShipment.com can turn out to be an incredibly simple way of protecting your parcels by helping you optimize costs at scale.

- Comprehensive protection to ship every order with a peace of mind

- Intelligent insurance automation to help you decide what get’s insured and what doesn’t

- Unified portal to effortlessly manage insurance claims

- Actionable insights to optimize operations and risk management

And so much more…

This is a guest post by Sydney Wess

Sydney Wess writes about supply chain and e-commerce trends for Clutch.

Wrapping up - Prevent Delivery Issues in the First Place

Shipping insurance is a valuable investment that helps you recover shipping expenses that arise due to common delivery issues, which otherwise may prove to be significant losses for your e-commerce business. But what if you could prevent such delivery issues in the first place and reserve insurance only for emergencies?

LateShipment.com’s Delivery Experience Management helps you stay ahead of lost or damaged packages with ease via real-time tracking that lets you identify delivery issues beforehand.

Since you get to know well in advance if a package is flagged as lost or damaged, it gives you an edge when you get in touch with the carrier to resolve the issue or send a quick replacement or offer exclusive discounts for customers who are facing them.

Well that’s all from us. It is now your turn to prevent delivery issues from damaging your customer relationships and lead to unwanted costs. Reduce the negative impact of delivery issues by 80% by proactively communicating with your customers and catering to their needs.

The days of worrying over delivery issues are long gone. It is time to recover unfortunate losses and avoid losing customers for such incidents.